PolyMet Events and News

November 19, 2019

PolyMet drilling program results in additions to NorthMet Mineral Resources and Reserves

St. Paul, Minn., November 19, 2019 – Poly Met Mining, Inc., a wholly-owned subsidiary of PolyMet Mining Corp. (together “PolyMet” or the “company”) TSX: POM; NYSE American: PLM, today announced updated Mineral Resources and Reserves for the NorthMet deposit based on results of its 2018-19 drilling program. Highlights include:

- Proven and Probable Reserves increased by 14% to 290 million tons;

- Measured and Indicated Resources increased by 22% to 795 million tons.

“We are pleased with the improvements the drilling program delivered to our mineral resource, with an additional 177 million pounds of copper, 53 million pounds of nickel and 322,000 ounces of precious metals added to the Proven and Probable Reserve category,” said Jon Cherry, president and CEO.

“The drilling program outcomes are indicative of our tremendous NorthMet asset and the progress we continue to make with the project,” Cherry said. “With a fully permitted project, we remain in ongoing discussions with potential lenders about financing while we also continue to identify opportunities to optimize and deliver the project in the most economic way possible.”

The results of drilling that commenced in the fourth quarter of 2018 and concluded in 2019 were used to convert material from the Inferred category into the Measured and Indicated Resource classifications. Subsequently, the Reserve was updated under NI 43-101 guidelines.

Updated NorthMet Mineral Resources and Mineral Reserves

Mineral reserves

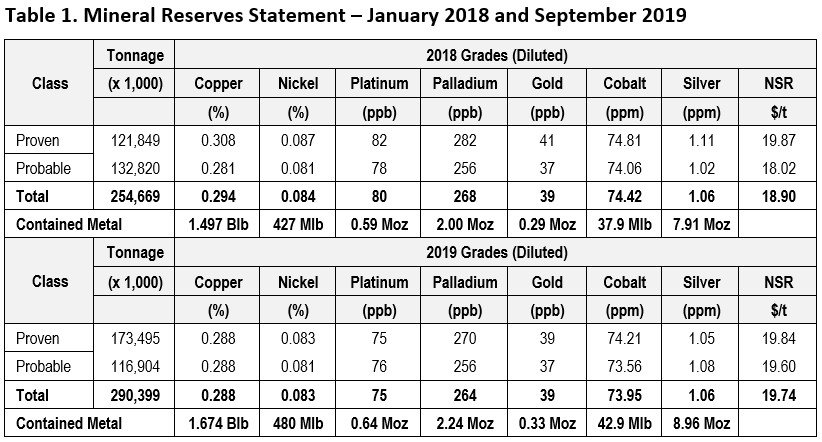

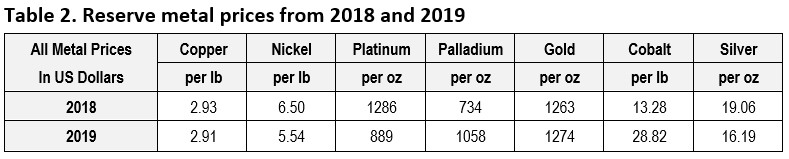

The 2018-19 drilling program increased the Proven and Probable Mineral Reserve by 35.7 million tons, or 14%. The January 2018 and September 2019 reserve statements are shown in Table 1. Metal prices used for the reserve calculations are shown in Table 2.

Notes:

- Mineral Reserves tonnage and contained metal are rounded to reflect the accuracy of the estimate; numbers may not add due to rounding.

- The 2019 Mineral Reserves estimate is effective as of September 2019. The QP for the estimate is Herb Welhener, RM-SME, of Independent Mining Consultants, Inc. The mineral reserves statement for January 2018 is extracted from the company’s March 26, 2018 technical report titled “NorthMet Project” (the “NorthMet Technical Report”).

- All reserves are stated above a $7.98 Net Smelter Return (NSR) cutoff and bound within the final pit design.

- Net Smelter Return includes payable metal values less concentrate transportation and smelting and refining costs.

- January 2018 pit; average waste: ore ratio = 1.47. September 2019 pit; average waste: ore ratio = 1.43

- Tonnage and grade estimates are in Imperial units. Estimation methodology has not changed from the NorthMet Technical Report.

- The risks that could materially affect the development of the NorthMet asset are set out under the heading “Risk Factors” in the company’s Annual Information Form dated March 28, 2019.

Mineral resources

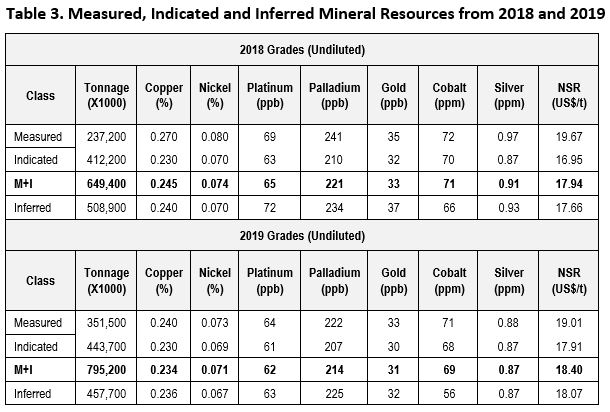

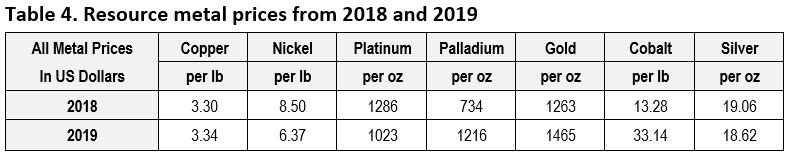

Mineral Resources statements from 2018 and 2019 are shown in Table 3. The additional drilling increased Measured and Indicated Mineral Resources by 146 million tons while decreasing the Inferred Mineral Resources by 51 million tons. The 2019 Mineral Resources prices are based on a 15% increase from the prices used in the 2019 Mineral Reserves estimates. Metal price assumptions are shown in Table 4.

Notes:

- Mineral Resources tonnage and grades are rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

- The 2019 Mineral Resources estimate is effective as of July 2019. The QP for the estimate is Zachary J. Black, RM-SME, of Hard Rock Consulting, LLC. The mineral resources statement for 2018 is extracted from the NorthMet Technical Report

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are reported inclusive of Mineral Reserves at $6.34 Net Smelter Return (NSR) cut-off. The Mineral Resources are considered amenable to open pit mining and are reported within an optimized pit shell. Pit optimization is based on total ore costs of $5.49/ton processed, mining costs of $1.15/ton at surface and increasing $0.02/ton for every 50 feet of depth, and pit slope angles of 48 degrees. Tonnages are reported in short tons (2000lbs)

- The Mineral Resources estimation methodology has not changed from the NorthMet Technical Report.

- The risks that could materially affect the development of the NorthMet asset are set out under the heading “Risk Factors” in the company’s Annual Information Form dated March 28, 2019.

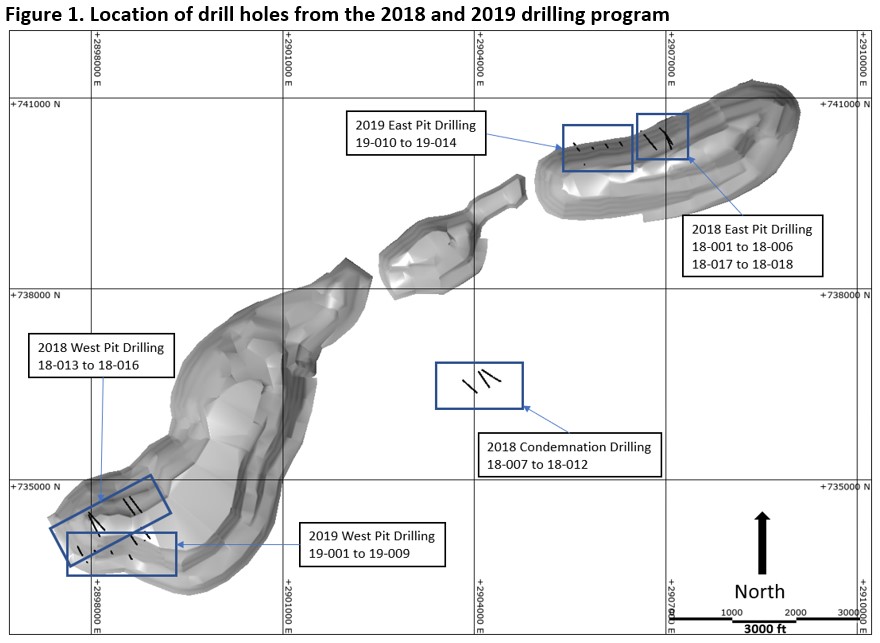

Drill hole locations

Drill hole locations from the 2018 and 2019 drilling program in the east and west pit, are shown in Figure 1. Table 5 contains a summary of all 2018 and 2019 drilling assay results. Table 6 contains the drill hole locations.