PolyMet Events and News

December 30, 2022

PolyMet Mining releases updated NI 43-101 Technical Report on NorthMet copper-nickel-PGM deposit

Report reaffirms economic and technical viability of NorthMet Project

St. Paul, Minn., December 30, 2022 – PolyMet Mining Corp. (“PolyMet” or the “company”) TSX: POM; NYSE AMERICAN: PLM – today announced the filing of an updated technical report (the “Study” or this “report”) prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) on the NorthMet Project. This report reaffirms the economic and technical viability of the NorthMet copper-nickel-precious metals project located near Hoyt Lakes, Minnesota.

This report, entitled “NorthMet Copper-Nickel Project Feasibility Update”, contains original plans but updated cost estimates for construction and operation of the NorthMet Project. Dated December 30, 2022, this report supersedes the previously filed NorthMet Project Technical Report published March 26, 2018.

This report provides technical and economic details for development of the mining operation in two distinct phases. Phase I involves development of 225 million tons – less than one-third of NorthMet’s known resource – into an operating mine processing 32,000 tons per day over a 20-year mine life. It also includes rehabilitating the former LTV Steel Mining Company processing plant and using state-of-the-art wastewater treatment to clean up water issues from legacy iron-ore operations at the site.

The revised capital costs for Phase I are estimated at US$1.2 billion and include refurbishment of the existing primary crushing circuit and replacing the existing rod and ball mill circuits with a new, modern semi-autogenous grinding (SAG) mill, ball mill and flotation circuit. It also includes rail and electrical system upgrades and mining equipment.

Phase II involves construction and operation of a hydrometallurgical plant to treat nickel sulfide concentrates into upgraded nickel-cobalt hydroxide and recover additional copper and platinum-group metals. While development of Phase II will be at the company’s discretion, both phases have been fully permitted, pending litigation. Phase II would increase project capital costs by approximately US$325 million.

“This report once again reaffirms the technical and financial viability of the 32,000 tpd case for which the project was permitted. An improved market forecast created by soaring demand for clean energy metals such as copper, nickel and cobalt more than offsets inflationary pressures and improves the project’s valuations and returns,” said Jon Cherry, chairman, president and CEO.

“Our focus remains on closing the proposed joint venture with Teck, clearing up outstanding litigation, meeting our environmental obligations under the terms of our permits, and financing and building the project,” Cherry said. The company in July entered into an agreement with Teck Resources Limited (“Teck”) to form the NewRange Copper Nickel LLC joint venture, placing their respective NorthMet and Mesaba deposits of clean energy metals under single management. The joint venture is expected to close by the end of Q1 2023, and is subject to receipt of customary closing conditions and receipt of certain regulatory approvals.

Technical Report Key Points

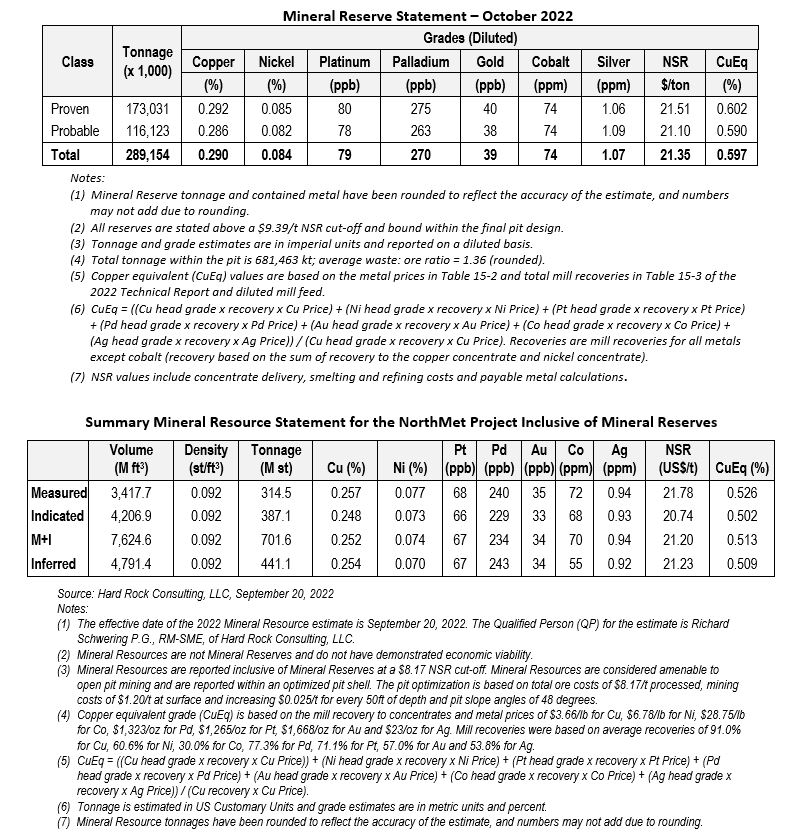

- Total Proven and Probable Mineral Reserves for the NorthMet project are estimated to be 289 million tons, with copper equivalent grade of 0.597 percent (after dilution).

- Measured and Indicated Mineral Resources total 702 million tons, with a copper equivalent grade of 0.513 percent.

- Inferred Mineral Resources are estimated at 441 million tons, with an estimated copper equivalent grade of 0.509 percent.

- After tax, net present value of future cash flow discounted at 7 percent is $304 million for Phase I, and $487 million inclusive of Phase II.

- After tax, internal rate of return is 10.5 percent for Phase I and 11.5 percent inclusive of Phase II.

- Improvements in metal price assumptions have helped offset increases in capital and operating expenses.

- Under Phase I, payable metals in copper and nickel concentrates are estimated at 1.1 billion pounds of copper, 133 million pounds of nickel, a combined 1.1 million ounces of platinum, palladium and gold, 1.1 million ounces of silver and 5.6 million pounds of cobalt.

- Under Phase II, payable metals in enriched copper concentrates and products from the hydrometallurgical plant are expected to increase to 1.2 billion pounds of copper, 179 million pounds of nickel, 1.7 million combined ounces of platinum, palladium and gold, 1.1 million ounces of silver and 6.4 million pounds of cobalt. Palladium is the predominant precious metals group (PGM) product, totaling 1.3 million ounces.

A summary of PolyMet’s Mineral Reserves and Mineral Resources is provided in the tables below. Please refer to the Study for important disclaimers on the viability or otherwise of reported Mineral Resources.

The report is based on feasibility-study-level engineering as well as the Final Environmental Impact Statement (from November 2015) and state and federal environmental permits obtained for NorthMet. PolyMet retained M3 Engineering & Technology Corporation, Independent Mining Consultants, SENET (Pty) Ltd., Hard Rock Consulting, LLC, and Barr Engineering Company to contribute to the Study. This report is available for review under the company’s profile on SEDAR (www.sedar.com) and on the company’s website (www.polymetmining.com).

Qualified Person Statement

The Study was prepared by Alberto Bennett, Daniel Neff, Daniel Roth and Laurie Tahija of M3 Engineering & Technology Corporation, Nicholas Dempers of SENET (Pty) Ltd., Thomas J. Radue and Jeff Ubl of Barr Engineering Co., Richard Schwering of Hard Rock Consulting and Herbert E. Welhener of Independent Mining Consultants. The scientific and technical content of this news release has been reviewed, prepared and approved by Andrew Ware, PolyMet chief geologist, who is a “Qualified Person” under NI 43-101.

* * * * *

About PolyMet

PolyMet is a mine development company that owns 100% of the NorthMet Project, the first large-scale project to have received permits within the Duluth Complex in northeastern Minnesota, one of the world’s major, undeveloped mining regions. NorthMet has significant proven and probable reserves of copper, nickel and palladium – metals vital to infrastructure improvements and global carbon reduction efforts – in addition to marketable reserves of cobalt, platinum and gold. When operational, NorthMet will become one of the leading producers of nickel, palladium and cobalt in the U.S., feeding the supply chain with high-demand, responsibly mined metals crucial to the manufacture of clean energy and clean mobility technologies such as wind and solar generation, battery storage and electric vehicles.

Located in the Mesabi Iron Range, the project will provide economic diversity while leveraging the region’s established supplier network and skilled workforce and generate a level of activity that will have a significant effect in the local economy. For more information: www.polymetmining.com.

For further information, please contact:

Media

Bruce Richardson, Corporate Communications

Tel: +1 (651) 389-4111

brichardson@polymetmining.com

Investor Relations

Tony Gikas, Investor Relations

Tel: +1 (651) 389-4110

investorrelations@polymetmining.com

PolyMet Disclosures

This news release contains certain forward-looking statements concerning anticipated developments in PolyMet’s operations in the future, including, without limitation, the statements regarding the ongoing development of PolyMet’s NorthMet Project. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words. These forward-looking statements may include statements regarding PolyMet’s beliefs related to the expected project development timelines, exploration results and budgets, reserve estimates, mineral resource estimates, continued relationships with current strategic partners, work programs, estimates capital and operating costs and expenditures, actions by government authorities, including changes in government regulation, the market price of natural resources, estimated production rates, ability to receive and timing of environmental and operating permits, estimated construction costs, job creation and other economic benefits, or other statements that are not a statement of fact.

Forward-looking statements and forward-looking information address future events and conditions and therefore involve inherent known and unknown risks and uncertainties. These risks, uncertainties and other factors include, but are not limited to, adverse general economic conditions, operating hazards, inherent uncertainties in interpreting engineering and geologic data, fluctuations in commodity prices and prices for operational services, government regulation and foreign political risks, fluctuations in the exchange rate between Canadian and US dollars and other currencies, as well as other risks commonly associated with the mining industry. Actual results may differ materially from those in the forward-looking statements and forward-looking information due to risks facing PolyMet or due to actual facts differing from the assumptions underlying its predictions. In connection with the forward-looking information contained in this news release, PolyMet has made numerous assumptions, regarding, among other things, that the geological, metallurgical, engineering, financial and economic advice that PolyMet has received is reliable and is based upon practices and methodologies which are consistent with industry standards, that PolyMet will be able to obtain additional financing on satisfactory terms to fund the development and construction of the NorthMet Project and that the market prices for relevant commodities remain at levels that justify construction and/or operation of the NorthMet Project. While PolyMet considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies.

PolyMet’s forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made, and PolyMet does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations and opinions should change.

Specific reference is made to risk factors and other considerations underlying forward-looking statements discussed in PolyMet’s most recent Annual Report on Form 40-F for the fiscal year ended December 31, 2021, and in our other filings with Canadian securities authorities and the U.S. Securities and Exchange Commission.

No regulatory authority has reviewed or accepted responsibility for the adequacy or accuracy of this release.