PolyMet Events and News

December 8, 2016

PolyMet Reports Third Quarter Fiscal 2017 Results

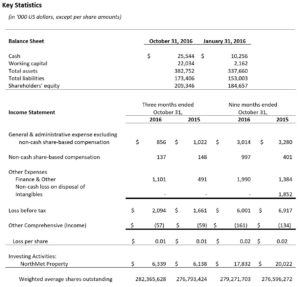

St. Paul, Minn., December 8, 2016 – PolyMet Mining Corp. (“PolyMet” or the “Company”) TSX: POM; NYSE MKT: PLM – announced today that it has filed its financial results for the three and nine months ended October 31, 2016. PolyMet controls 100 percent of the development-stage NorthMet copper-nickel-precious metals ore body and the nearby Erie Plant, located near Hoyt Lakes in the established mining district of the Mesabi Iron Range in northeastern Minnesota.

The financial statements have been filed at www.polymetmining.com and on SEDAR and EDGAR and have been prepared in accordance with International Financial Reporting Standards. All amounts are in U.S. funds. Copies can be obtained free of charge by contacting the Corporate Secretary at First Canadian Place, 100 King Street West, Suite 5700, Toronto, Ontario M5X 1C7 or by e-mail at info@polymetmining.com.

Highlights of Fiscal 2017 to date

- On March 3, 2016, the state determined that the NorthMet Final Environmental Impact Statement addresses the objectives defined in the EIS scoping review, meets procedural requirements and responds appropriately to public comments. The 30-day period allowed by law to challenge the state’s decision passed without any legal challenge being filed. The Final EIS demonstrates that the NorthMet Project can be constructed and operated in compliance with environmental and human health standards;

- On June 2, 2016, the Company agreed to issue up to an additional $14.0 million secured debentures to Glencore AG, a wholly owned subsidiary of Glencore plc (together “Glencore”), to fund permitting and general corporate purposes. The debentures are on similar terms as the existing non-convertible senior secured Tranche F-J Debentures;

- On July 1, 2016, repaid $4.0 million initial principal loan from the Iron Range Resources and Rehabilitation Board;

- On July 11, 2016, the Company submitted applications for water-related permits required to construct and operate NorthMet;

- On July 12, 2016, the Eastern Region Office of the U.S. Forest Service issued its response to comments on the draft Record of Decision for the land exchange and instructed the Superior National Forest to proceed with completing the final ROD;

- On August 2, 2016, the Company renewed its request for Water Quality Certification under Section 401 of the Clean Water Act;

- On August 24, 2016, the Company submitted the air quality permit application required to construct and operate NorthMet;

- On September 14, 2016, the Company and Glencore agreed to extend the maturity date of outstanding secured convertible debentures and outstanding secured non-convertible debentures to the earlier of March 31, 2018, availability of $100 million of debt or equity financing, or when it is prudent for the Company to repay the debt;

- On October 18, 2016, the Company closed the initial tranche of a private placement of 25,963,167 units for gross proceeds of $19.472 million;

- On October 28, 2016, the Company closed the second tranche of a private placement of 14,111,251 units for gross proceeds of $10.583 million pursuant to Glencore’s right to maintain its pro rata ownership;

- On November 3, 2016, the Company submitted the Permit to Mine application required to construct and operate NorthMet.; and

- As of October 31, 2016, PolyMet had spent $114 million on environmental review and permitting, of which $108 million has been spent since the NorthMet Project moved from exploration to development stage.

Goals and Objectives for the Next Twelve Months

The environmental review and permitting process is managed by the regulatory agencies and, therefore, timelines are not within PolyMet’s control. Given these circumstances, PolyMet’s objectives include:

- USFS issuance of its final ROD on the proposed land exchange and transfer of title to the surface rights over and around the NorthMet mineral rights to PolyMet;

- Decision on 401 Water Quality Certification and U.S. Army Corps of Engineers final ROD and 404 wetlands permit under the Clean Water Act;

- Decisions on key state permit issuance – Permit to Mine, air and water permits;

- Completion of Definitive Cost Estimate and Project Update following permits;

- Completion of project implementation plan;

- Repayment, restructuring, and/or conversion of Glencore loans; and

- Completion of construction finance plan including commitment of debt prior to the issuance of permits, subject to typical conditions precedent such as receipt of key permits.

* * * * *

About PolyMet

PolyMet Mining Corp. (www.polymetmining.com) is a publicly traded mine development company that owns 100 percent of Poly Met Mining, Inc., a Minnesota corporation that controls 100 percent of the NorthMet copper-nickel-precious metals ore body through a long-term lease and owns 100 percent of the Erie Plant, a large processing facility located approximately six miles from the ore body in the established mining district of the Mesabi Iron Range in northeastern Minnesota. Poly Met Mining, Inc. has completed its Definitive Feasibility Study. The NorthMet Final EIS was published in November 2015, preparing the way for decisions on permit applications. NorthMet is expected to require approximately two million hours of construction labor, creating approximately 360 long-term jobs, a level of activity that will have a significant multiplier effect in the local economy.

For further information, please contact:

Media

Bruce Richardson

Corporate Communications

Tel: +1 (651) 389-4111

brichardson@polymetmining.com

Investor Relations

Jenny Knudson

Investor Relations

Tel: +1 (651) 389-4110

jknudson@polymetmining.com

PolyMet Disclosures

This news release contains certain forward-looking statements concerning anticipated developments in PolyMet’s operations in the future. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words. These forward-looking statements may include statements regarding the ability to receive environmental and operating permits, job creation, and the effect on the local economy, or other statements that are not a statement of fact. Forward-looking statements address future events and conditions and therefore involve inherent known and unknown risks and uncertainties. Actual results may differ materially from those in the forward-looking statements due to risks facing PolyMet or due to actual facts differing from the assumptions underlying its predictions.

PolyMet’s forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made, and PolyMet does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations and opinions should change.

Specific reference is made to PolyMet’s most recent Annual Report on Form 20-F for the fiscal year ended January 31, 2016 and in other filings with Canadian securities authorities and the U.S. Securities and Exchange Commission, including our Report on Form 6-K providing information with respect to operations for the three and nine months ended October 31, 2016, for a discussion of some of the risk factors and other considerations underlying forward-looking statements.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.